Market Overview and Interest Rate:

Wall Street completed the trading day on Monday, October 2, 2023, with investors wondering if the Federal Reserve will maintain higher interest rate. This thought caused major indexes to move differently.

The S&P 500 index rose 0.01 percent, or 0.49 points, to 4,288.54. Additionally, 88.45 points were added to the Nasdaq, bringing the total up to 13,307.77, an increase of 0.67 percent. The decline brought the Dow Jones Industrial Average down to 33,433.42, or a 0.22 percent drop, or 74.08 points.

Federal Reserve and Interest Rate View:

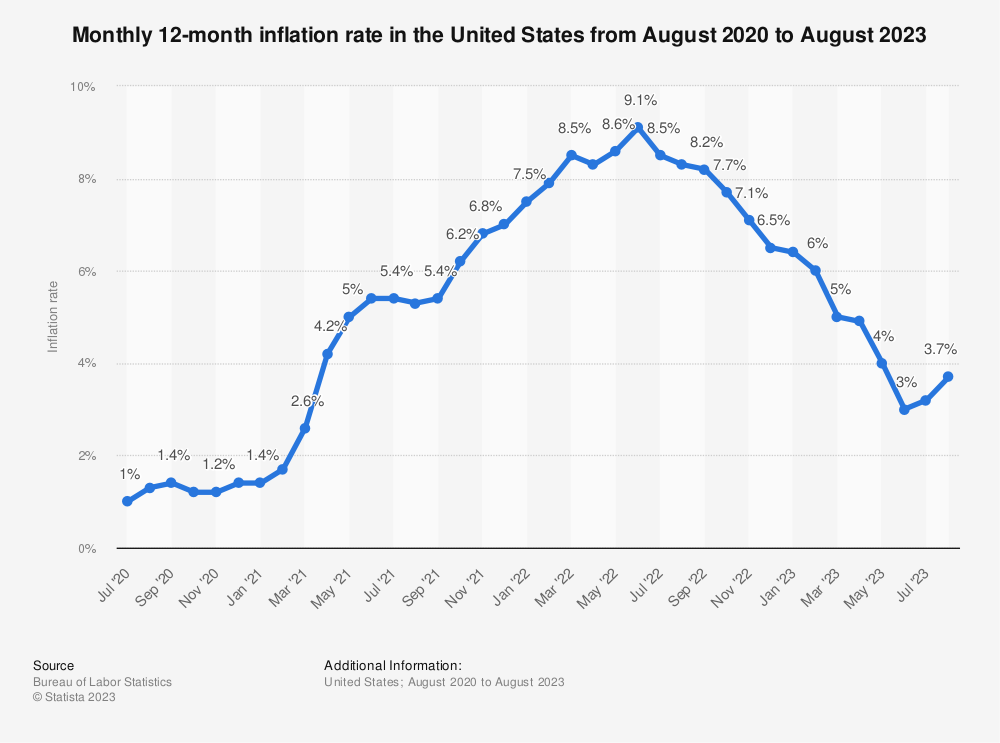

Market players focused on the Fed’s interest rate position. Governor Michelle Bowman supports a rate hike at the next meeting if inflation data shows a slowdown. The Federal Reserve recently acknowledged the difficulties of meeting the yearly 2% inflation objective.

Market Uncertainty:

September ended with market uncertainty. Investors eagerly anticipating corporate earnings growth and Fed direction in October. The market was unclear at the end of September, according to LPL Financial Chief Global Strategist Quincy Krosby. Reuters reports that the market wants assurance that corporate earnings are rising and Fed direction this month.

Investors watched US bond yields rise at the start of the week, connected to an agreement to avoid a government shutdown.

Performance by Sector:

Sectors in the S&P reacted differently to uncertainty. The interest rate-sensitive utility industry was one of the worst performers. The technology industry grew as the energy sector declined.

Utility stocks saw NextEra Energy fall to its lowest level since March 2020. Investor confidence in Nvidia was boosted after the investment bank Goldman Sachs included the company on its “conviction list.” Due to electric vehicle deliveries missing market expectations, Tesla stock performance was sluggish.

Economic Data and Earnings:

US construction spending rose in August, according to economic data. Investors eagerly await the monthly US jobs report on Friday, October 6, 2023.

This month brings S&P 500 third-quarter earnings releases. Analysts expect these reports to show higher company earnings than previous year.

Fed Policy’s Global Impact:

Global central banks often cite the Federal Reserve’s interest rate policies, according to economist Ryan Kiryanto. Kiryanto cautioned that the Fed’s actions shouldn’t be applied to other central banks.

Kiryanto noted that other central banks may not follow The Fed’s lead due to the US’s unique economic situation.

Future Interest Rate Forecasts:

There is speculation that the Fed may lower the benchmark interest rate by 50 basis points in 2024. This forecast is significantly lower than the June 100 basis point drop estimate.

Federal Open Market Committee (FOMC) Chair Jerome Powell stressed that inflation and macroeconomic data will influence future interest rate policy. This emphasizes the Federal Reserve’s data-driven monetary policy and responsiveness to changing economic conditions.